Taxes, estate planning, investments, “oh my!”

College financial aid, becoming responsible for Mom’s finances (or health care), figuring out my pension or Social Security options are some examples of why people become overwhelmed. Our lives are demanding enough without having to learn a whole new vocabulary or set of procedures. Unfortunately, when people are in an emotional, reactive state, they’re often called to make significant decisions. If you’re ever called to represent a loved one’s best interests in court, you will quickly remember how it feels to be in an “on the job training” (OJT) situation. For many people, that was okay in their 20’s when they had the time, energy and naïve confidence to tackle the unknown. Ask a 52-year old wife and mother of three to explain what it’s like to research nursing homes for Dad, provide emotional support for Mom, comb through several decades’-worth of documents in filing cabinets, meet with bankers, establish her authority to talk with a financial institution–ALL WHILE TRYING TO KEEP UP WITH: her job, her children, her husband and her “downtime” (as if downtime even exists anymore).The sad thing about these demands is that the learned skills are only used once or twice in the 52-year-old daughter’s life. Her efforts will consume her “free” time while her siblings and immediate family members fail to understand the toll on her family, body and soul. “Underappreciated” is a word added to the dictionary to describe this person’s role.Other examples of overwhelming situations include impending college decisions/expenses for a child, big job changes, relocations and when to start Social Security and timing of retirement. In our experience, getting a professional’s guidance during these trying life events can ratchet down the stress level and provide a sense of confidence.We are here to help you design a game plan to get through this overwhelming period. It all starts with a phone call and complimentary face-to-face meeting. From that point, you’ll know who to involve, what to do and how much it will cost to remove this burden from your already-full plate.

Call or text to schedule a good time to talk 720.903.1510

COMPANY INFORMATION

Office: (720) 903-1510

Admin@FortunateFamilyOffice.com

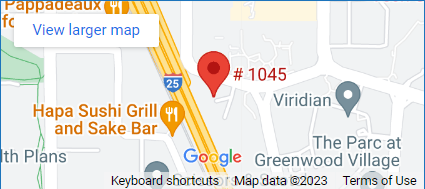

Collocated at Western Wealth Advisors

5251 DTC Parkway

Suite 1045

Greenwood Village, CO 80111

QUICK LINKS

SCHEDULE APPOINTMENT

Check the background of investment professionals associated with this site on FINRA’s BrokerCheck

The content is developed from sources believed to provide accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. The opinions expressed and material provided are for general information, and should not be considered a solicitation for the purchase or sale of any security.

Securities offered through LPL Financial, Member FINRA & SIPC. Investment advice offered through Western Wealth Management, a registered investment advisor. Western Wealth Management and Fortunate Family Office are separate entities from LPL Financial.

The LPL Financial registered representatives associated with this website may discuss and/or transact business only with residents of the states in which they are properly registered or licensed. No offers may be made or accepted from any resident of any other state.

Licensed to sell insurance in the following States: CO

FINRA Series 7 for Wade Olson held with LPL Financial. Series 66 for Wade Olson held with Western Wealth Management, LLC.